All About Superbills: A Guide for Mental and Behavioral Health Providers

As a behavioral health professional, you'll likely have a client ask for a superbill at some point in your career. When that moment arrives, it helps to be ready to give your client the document they requested in just a few minutes. Creating a superbill can be a simple process once you have a mental health superbill template made and understand how it works. Depending on the type of electronic health record (EHR) software you have, you may be able to quickly generate a superbill directly in your EHR.

If you've never created a superbill before, we're here to help. In this guide, we'll show you reasons to use superbills and what you need to include in the document.

Table of Contents

- What Is a Superbill For Therapy?

- How Does Payment Work?

- When Are Superbills Necessary?

- How Do You Prepare for a Superbill Request?

- How Do Behavioral Health Providers Use Superbills?

- What Are the Benefits of Superbills?

- How Do You Make a Superbill?

- What to Exclude From a Superbill

- Who Submits a Superbill For Therapy?

- How to Stay Organized With Superbills

- Create a Superbill With ICANotes

What Is a Superbill For Therapy?

A superbill is an itemized document that details the list of services you have provided to your client. A document like this allows clients to bill their insurance company directly which helps them get reimbursed for service if your practice does not accept their insurance. Superbills include information similar to an insurance claim form, such as the date of the service provided, procedure codes and a total balance due. Once you give your client a superbill, they can submit it to their insurance company.

How Does Payment Work?

Superbills do not affect your rates or whether you'll get paid for the services you provide. Typically, therapists ask clients for payment immediately after a therapy session. If the clinician is an out-of-network provider for a client, they can give the person a superbill after they pay. The client can then use the superbill to try to get reimbursed for the session by their insurance company — if their plan offers out-of-network benefits for the services they received.

Assuming a client has out-of-network coverage, the amount they paid for your services may either get applied to their deductible or reimbursed and sent to them by check. Whether or not your client gets reimbursed depends on the type of coverage they have. You should not receive any payment from their insurance company.

When Are Superbills Necessary?

Superbills are not mandatory, and it's up to you whether you want to offer this option to your clients. If you decide you want to work with your client's insurance company indirectly, you can help them pay for their treatment. You might offer superbills under any of the following circumstances:

- You applied to insurance panels and are waiting to get accepted.

- You do not have a contract with any insurance company.

- You are only on a few select insurance panels.

- You want to help your clients pay for therapy, even though you are an out-of-network provider.

How Do You Prepare for a Superbill Request?

You can have a superbill ready for your clients after each session by creating a template. The secret is to create a superbill template that includes the most frequently used codes in your practice and ensure the form has space for the essential elements, which we'll cover more below. You may also be able to use your EHR system to create a superbill in minutes.

It's a good idea to discuss superbills with your clients before you begin to have regular sessions. Encourage your clients to review their health insurance benefits, so they know how much reimbursement to expect. Some policies do not cover out-of-network services, while others may pay for a portion of a therapy session. Your clients may also need to consider out-of-network deductibles, copays and coinsurance. If your client has questions about their insurance benefits, encourage them to reach out to their insurer to verify their coverage and learn about out-of-network benefits.

How Do Behavioral Health Providers Use Superbills?

Superbills allow out-of-network therapists to attract and retain clients who have insurance. As mentioned, behavioral health professionals may use superbills if they are an out-of-network provider for a client and want to help them get reimbursed. Superbills generally aren't for in-network billing.

You can require clients to pay out of pocket first, then give them a superbill after each session. You might also give clients superbills at the end of the month, including details about each appointment and related costs. It's up to you whether you want to provide superbills after each session or monthly.

Once you give your client the superbill, you don't need to do anything else. Your only job is to provide accurate information on the superbill to help your client. It's then up to your client to work out reimbursement with their insurance company.

What Are the Benefits of Superbills?

Creating superbills may take a little time and effort until you develop a routine, but it may be worth the extra step. Superbills can help you gain clients' loyalty and trust, which can boost your practice overall. Here are some of the advantages of superbills.

- Help your clients: Clients are likely to feel more satisfied with your services if their insurance company helps pay for them. If they can get reimbursed for therapy sessions, they are more likely to continue treatment and feel more at ease about appointments. You may also help clients who couldn't find a niche therapist in their network.

- Help your practice: Superbills for therapy allow you to attract clients who have insurance, even if you do not accept insurance. By bringing on more clients, you can expand your practice. If they are happy with your services, they might tell friends or family to visit you as well.

- Reduce paperwork: You probably would rather spend time helping clients heal than filling out insurance claims. If you've avoided joining insurance panels to avoid extra paperwork, know that you don't have to worry about a lengthy process with superbills. Your client will do most of the work.

- Get paid immediately: When you offer superbills, you ask for payment after each session, and it's up to your client to contact their insurance company and submit the required forms. You will not be the one on the phone or computer figuring out what to do next. You also won't have to wait until insurance claims get accepted to get paid.

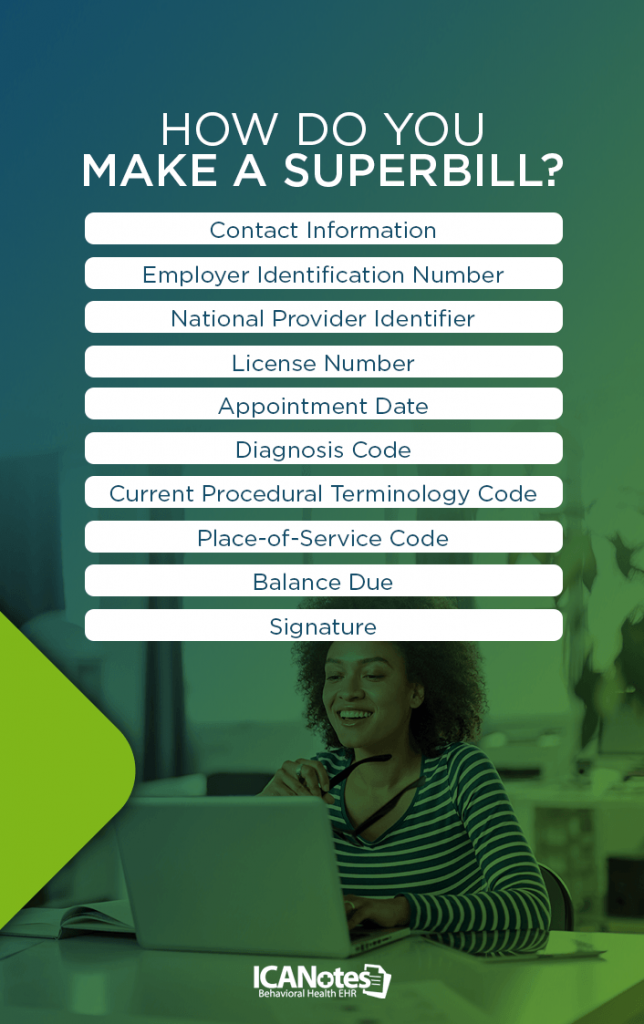

How Do You Make a Superbill?

Superbills are usually a single page and need to include some essential details, such as contact information and diagnostic codes. As an example, consider this medical claim form provided by United Healthcare. Assuming your client has a plan with this company, they would need to fill out this medical claim form and send it to their insurer. Your superbill would provide the information they need to complete the form correctly. In this example, your superbill must include the following:

- Patient name

- Diagnosis codes

- Procedure codes and applicable modifiers

- Units, which equal 15 minutes apiece, for each procedure code

- The amount for each procedure code

- Place of service code

Your client would also need to attach your superbill to their claim form. As United Healthcare states, missing information can lead to delayed payment or a denied claim, so the data must be accurate and clear.

Other insurance companies may have different requirements, so it's good to create a general template that includes information any insurance company might request. You'll want to include these sections in your superbills template.

Contact Information

Superbills must contain the following client contact information:

- First and last name

- Date of birth

- Address

- Phone number

Your client's contact information may include anything the insurer requests to identify the client. For example, your template may have fields to include insurance information, such as your client's plan and ID number.

You must also provide your contact information, including:

- First and last name

- Practice name, if applicable

- Practice address

- Phone number

- Email address

Employer Identification Number

If you operate an independent practice, you likely have an employer identification number, or EIN. You probably use your EIN to submit claims to insurance companies if you accept insurance. It's much safer to use your EIN than your Social Security number when filling out any paperwork, including superbills. If you don't already have an EIN, you can apply for free through the IRS. If you have an EIN but can't find it, you can ask the IRS for assistance by calling their Business and Specialty Tax Line.

You'll need to include your EIN at the top of your superbill, along with your contact information.

National Provider Identifier

If you don't accept insurance, you may not have a national provider identifier, or NPI. An NPI is a 10-digit identification number provided by the Centers for Medicare and Medicaid Services (CMS). Any health care provider who electronically bills a government or private health insurer must use their NPI to comply with the Health Insurance Portability and Accountability Act. Clinicians who are not a "covered entity" and bill insurers by mail may still need an NPI if an insurer requires one. Therefore, it's worth having an NPI, whether you're a covered entity or not.

If you already have an NPI, you'll need to place it at the top of the superbill near your EIN. If you need an NPI, you can follow the application steps provided by the CMS.

License Number

Include the license number you received to practice therapy in your state at the top of the superbill. You can contact your state licensing board if you have questions about your license number.

Appointment Date

You'll need to include the date you met with your client. If you have a superbill containing multiple sessions, you might put the different dates next to each relevant procedure code.

Diagnosis Code

After you include contact information and appointment date, you'll need a space to enter the appropriate diagnosis codes found in the Diagnostic and Statistical Manual of Mental Disorders (DSM) or the International Statistical Classification of Diseases (ICD).

Each diagnostic code shows your client's insurance company why they are receiving your services. It's best to use the latest versions of the DSM and ICD to ensure accuracy. These are the DSM-5 and ICD-10-CM.

Current Procedural Terminology Code

Next, include a checklist of frequently used current procedural terminology, or CPT, codes to show insurers the services you provided and the amounts you charged for each one.

CPT codes describe the services you use to treat your patient's diagnosis. These five-digit codes follow a uniform language created by the American Medical Association. The CMS assigns amounts to CPT codes for Medicare coverage, which many insurance companies base their reimbursement rates on.

Be sure to provide a correct CPT code for each service to help your client get reimbursed. Next to each CPT code, include a description of the service, which is usually just the name of the associated code. For example, for the CPT code 90837, you would write "Individual psychotherapy." Then, next to that, enter how much you charged for the service.

Place-of-Service Code

You may also need room on the superbill to include the place-of-service code. This number does not refer to your office's physical location. Instead, it relates to where and how you met your client. For example, if you held a therapy session in your office, you would use 11. If you conducted a teletherapy session, you would use 02. The CMS provides a list of codes you can use as a reference.

Balance Due

On the bill, include the total charge for the services provided, the amount your client paid and the balance due. If your client paid you in full for your services, you might include a statement informing the insurance company of this fact.

Signature

The last part of a superbill includes your signature and date.

What to Exclude From a Superbill

Superbills only need to contain an insurer's required information. Unless an insurance company requests more, you do not have to attach progress notes to the superbill. If an insurer asks to see a client's notes, make sure your client has signed the proper consent form. Insurance companies do not have the right to see your private psychotherapy notes.

Who Submits a Superbill For Therapy?

Your client is responsible for submitting the superbill to their insurance company, and you may want to make this clear before you begin therapy sessions. However, you can submit a superbill on your client's behalf if you feel comfortable doing so.

How to Stay Organized With Superbills

Superbills require a fair amount of information with each new request. If you use EHR software to create a superbill, you can easily stay organized and complete the document for your clients quickly and accurately. With ICANotes' EHR software, for example, you can generate a superbill for a patient visit in a few clicks. With patient information and relevant CPT codes at your fingertips, you can ensure your superbill is accurate with little time and effort. You'll also have a copy of the superbill stored in your EHR, so you won't have to find a secure file cabinet to keep a paper copy.

Create a Superbill With ICANotes

As long as you include the required information in an easy-to-read format, you can tailor your superbill template to meet your needs. You might also use your EHR to simplify the process.

ICANotes allows you to create superbills directly in your EHR for a streamlined experience. With our Chart Face feature, you can click on a client's account and quickly pull data to generate a superbill. If you're ready to explore the billing capabilities of ICANotes, sign up for a free trial and give it a try.

Related Posts

How to Bill for Longer Couples & Family Therapy Sessions

Mental & Behavioral Healthcare Billing: How to Maximize Your Reimbursement Rate

CPT Code Basics: What You Should Know

Last updated April 20, 2023.